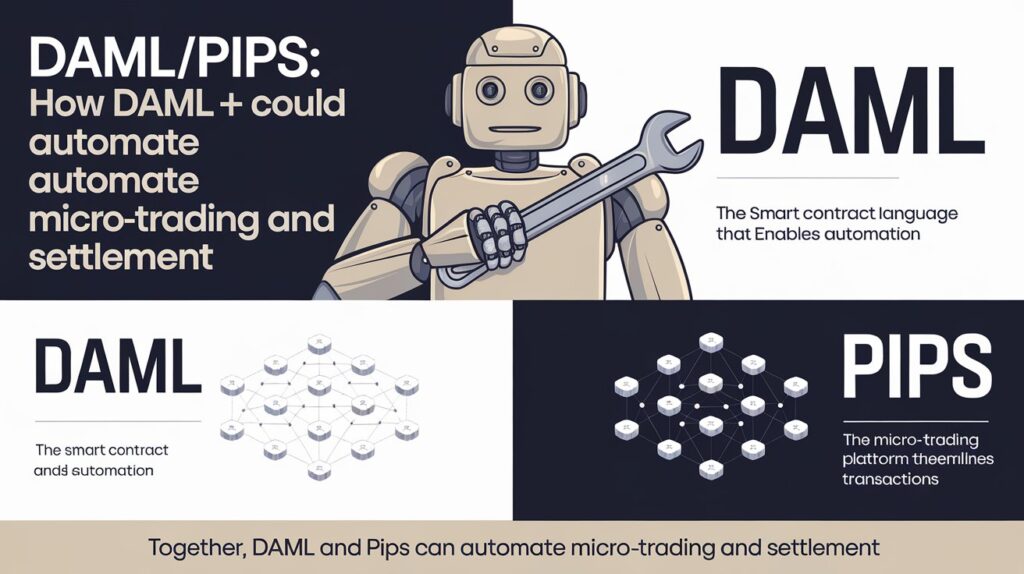

Damlpips is an emerging shorthand that blends DAML (the smart-contract language) with “pips” (the tiny price moves traders track). Think of damlpips as the idea of encoding tiny market movements and execution rules inside composable smart contracts so trades, settlements, and risk checks happen automatically and audibly.

What does that actually change for a trader or dev?

It turns manual pip math, reconciliation, and post-trade steps into deterministic code that responds to price feeds. In short: fewer manual errors, faster settlement, and clearer audit trails.

Quick primer: DAML and pips (the building blocks)

DAML is a purpose-built smart contract language for multi-party business logic — meant to run on ledgers and handle permissioned, privacy-aware workflows. It’s designed for financial applications where rules and roles matter.

What’s a pip?

A pip is the standard smallest price move in forex and many trading instruments (usually 0.0001 for most currency pairs). Traders count pips to measure profit, loss, and spread.

How do these two fit?

DAML provides the “contracts” and enforcement; pips are the granular measurement smart contracts can monitor and act upon.

What damlpips looks like in practice (real, simple examples)

- Automated micro-stop/limit: a DAML contract watches price feed; when price moves X pips it triggers a limit order and records settlement terms automatically.

Question: Can this prevent human lag? — Yes: code executes the logic without manual clicks, reducing reaction time. - Atomic pip settlement between counterparties: both sides sign a contract that pays net pip differences at a defined cadence.

Question: Does that mean faster cash flows? — Often yes: fewer reconciliation steps and deterministic triggers speed the back-office. - Audit trail: every pip event that caused a payment is recorded in ledger-readable form for regulators or compliance teams.

Question: Will auditors actually like this? — They will value deterministic logs and clear provenance, provided the ledger is permissioned and auditable.

Why professionals pay attention (benefits, not hype)

- Deterministic execution: no ambiguous human instructions.

- Lower reconciliation cost: machine-readable outcomes cut dispute time.

- Composable workflows: combine pricing logic, margin rules, and KYC checks inside one model.

- Privacy by design: DAML supports multi-party privacy patterns for sensitive trades.

Question: Is this just theoretical savings? — Plenty of firms already use DAML for trade workflows; applying it to pip-sensitive microtrading is a natural extension supported by the platform’s design.

If you’re exploring innovative financial approaches beyond damlpips, you might also enjoy learning about Effective Cwbiancamarket Strategies by Conversationswithbianca.

Risks and real constraints to watch

- Market feed reliability: smart rules are only as good as the price feed (oracles).

Question: What if the feed glitches? — You need resilient, multi-source oracles and fallback logic inside the contract. - Latency demands: ultra-low-latency HFT pips aren’t the same use case as permissioned post-trade automation.

Question: Can DAML do HFT? — Not the usual target. DAML shines in multi-party, regulated workflows, not raw microsecond market making. - Regulatory & integration costs: connecting to custodians, exchanges, and compliance systems takes work.

Question: Is the effort worth it? — For institutions that value automation, auditability, and counterparty safety, yes — but pilot first.

How to get started (practical next steps)

- Learn the language: start at the official docs and tutorials to understand templates and choices.

- Prototype locally: write a small DAML contract that listens to a mock pip feed and triggers a settlement action (use the SDK and scenarios).

- Use resilient market data: integrate two independent feeds and encode fallback rules inside the contract.

- Run pilots with a permissioned ledger: test privacy, settlement, and auditability before production.

Question: Where’s the best learning path? — The official docs and GitHub repos are the fastest route; follow the tutorials and build small scenarios first.

Is damlpips “real” or just a buzzword?

damlpips currently appears as an emerging term in specialist writeups and niche sites describing the fusion of DAML with pip-level trading logic. There are domain traces and small explainers, but mainstream adoption under that exact name is still early. Treat the concept as a practical pattern rather than an established industry standard.

Question: Should you bet a project on the name? — No. Bet on the underlying building blocks (DAML, robust oracles, proven settlement flows). The naming can follow later.

Summary takeaway: damlpips = using DAML’s smart-contract strengths to handle pip-level trading logic, settlement, and auditability. It’s promising for regulated institutions that need deterministic pip handling and clear provenance — but requires careful design around oracles, latency expectations, and integration.

And if you’re in the mood to switch gears from markets to makeovers, check out Transform Your Home with Style: Discover the Perfect Wallpaper Shop for Every Space — a complete guide to elevating your space.